Resources

Latest Posts

If your insurer hasn't responded to your appeal, discover how to check status and enforce review deadlines.

We know how frustrating it is to feel ignored by your insurance company, especially when your health is on the line. But you don’t have to wait endlessly—your insurer is legally required to review and respond to your appeal within set timelines.

If you haven't heard back about your appeal–here's how to hold them accountable and make sure they stick to their deadlines.

Quick Summary – More details below:

- Call member services for a status update—you deserve quick answers.

- Use the tips below to get results and avoid delay tactics.

- If you're being ignored, file a complaint with their regulator—they’re there to help!

"Never give in, never give in, never, never, never, never—in nothing, great or small, large or petty—never give in except to convictions of honor and good sense."

–Winston Churchill

How long does my insurer have to review my appeal?

The Affordable Care Act and ERISA regulations set strict rules for how appeals are handled: who reviews your appeal, how and when they must share decisions, and the specific timelines they must follow. Below are the general review timelines, but be sure to check your denial letter for specifics to your plan.

Below are the required timelines for various types of appeals.

• Expedited Service: 72 hours

• Experimental Service: 7 days

• Prior Authorization: 15 days

• Upcoming Service: 30 days

• Received Service: 60 days

You can request an expedited appeal if waiting for a claim decision may put your health at risk, such as if you urgently require medication due to a risk to health or severe pain, or are currently in the hospital. Formulary exceptions also qualify for 72 hours reviews, when you request a treatment not covered by your plan because it is medically necessary.

How do I know when my appeal was received?

We submit your appeal via Fax and First-Class Mail with tracking to ensure delivery. You’ll receive an email receipt confirming when your appeal was faxed, and mail delivery typically takes 3-5 days. If there’s an issue with delivery, we’ll let you know and work on alternative methods. If you need a detailed tracking report–reach out to support@getclaimable.com.

How can I find out my appeal status?

Call the member services number on the back of your insurance card and ask for an update on your appeal. Sometimes your provider may receive updates faster, so it’s worth checking with them too.

Can Claimable contact my insurer for me?

Your appeal is 100% yours—Claimable helps you create and send it, but we don’t contact your insurer directly or receive updates on your behalf. Because of this, you, in addition to your health provider, will be the ones to receive any updates or decisions from your insurance company.

How Can I Check My Appeal Status?

Unfortunately, insurers often use delay tactics to avoid processing appeals. Here’s how to handle common excuses:

They say: “We never received your appeal.”

You say: “I have proof it was received on [date] at [fax number] and on [date] at [address]. Please check again. I’ve also copied regulators, your CEO, and other decision-makers. Let me know if you need a detailed tracking report.”

They say: “We need more time to review.”

You say: “No, unless you can provide a valid reason in writing today that meets legal criteria for an extension. The law requires a decision within [review days], and I’ll file a complaint with [regulator] if there’s no compliance.”

They say: “You can’t appeal.”

You say: “Under the Affordable Care Act (or ERISA for self-funded plans), I have the right to appeal, including requesting exceptions to plan policies like step therapy or formularies when medically necessary. I am entitled to my own internal and external appeals, in addition to any requests or appeals sent by my health provider.”

What If I Don’t Hear Back?

Ignoring appeals is illegal. If your insurer doesn’t respond within the required timeline, you should file a complaint with your regulator—typically your state's Insurance Commissioner or the Department of Labor if you're on a self-funded plan.

Here's a breakdown of who to file a complaint with, depending on your plan type:

- Department of Labor (EBSA / ERISA): For self-funded employer plans

- State Departments of Insurance: For fully-insured employer plans, state or local government employers, and individual or exchange-purchased plans

- Centers for Medicare and Medicaid Services: For Medicare and Medicare Advantage plans

- State Medicaid Agencies: For Medicaid plans

- Office of Personnel Management : For federal employer plans

Denied your appeal? Don’t give up. Learn about your options for internal and external appeals, regulatory complaints, and legal action to fight for the care you need.

I know how frustrating it can be to receive another denial after you’ve already fought so hard. But I want to encourage you—this isn’t the end of the road. Many patients successfully win their second or even third appeal, and I’m here to help you get through this process. At Claimable, we’ve seen firsthand how persistence can pay off, and I want to make sure you have everything you need to keep moving forward.

Let’s walk through your options and how you can strengthen your next appeal.

My appeal was denied - can I file another appeal?

Yes! You have the right to multiple levels of appeal. These usually include internal reviews by your insurance company and external reviews by independent bodies. Your denial notice will explain how to re-appeal, including options for urgent cases.

How do I strengthen my next appeal?

Here’s what we’ve learned from analyzing successful appeals:

- Activate Influencers: Journalists, healthcare providers, or even industry leaders and politicians can help put pressure on insurers.

- Executive Outreach: Appeals directed to senior executives (like the CEO or medical officers) often get faster responses.

- Employer Outreach: If you’re in a self-funded plan, your employer’s leadership (like the CEO or CFO) is ultimately responsible for the plan.

- Review Your Claim File: Look for mistakes or inconsistencies that can strengthen your appeal.

- Build Your Case: If the insurer took too long, used unqualified reviewers, or broke any rules, that can boost your chances.

- Legal Support: If your case is urgent or complex, consider reaching out to a legal expert.

What are the different levels of appeal options?

STEP 1

Internal Appeals

This is your first step—ask your insurance company to reconsider. You may need to appeal twice before moving to an external review. Be sure to submit any new evidence or arguments.

STEP 2

External Appeals

An independent board will review your case and make a decision, assigning a medical expert or review board. If they overturn the denial, your insurer must comply.

STEP 3

Regulatory Complaints

If your appeals aren’t successful, you can file a complaint with a regulatory agency, which may decide to investigate and intervene on your behalf.

STEP 4

Legal Action

If all else fails, legal action may be an option. Self-funded plans, Medicare, and federal employer plans usually go to federal court, while other plans often go to state court.

Appeal Options by Health Plan Type:

Self-Funded Employer Plans (most large insurers)

Appeal options:

1st: Internal Review

2nd: Internal Review*

3rd: External Review

4th: Regulator Complaint

5th: Legal Action

Relevant regulator:

Employee Benefits Security Administration (EBSA)

Fully-Insured Employer Plans

Appeal options:

1st: Internal Review

2nd: Internal Review*

3rd: External Review

4th: Regulator Complaint

5th: Legal Action

Relevant regulator:

State Insurance Commissioner (NAIC)

Individual / Exchange Plans

Appeal options:

1st: Internal Review

2nd: Internal Review*

3rd: Regulatory Complaint

Anytime: Legal Action

Relevant regulator:

State Insurance Commissioner (NAIC)

State & Local Government Employee Plans

Appeal options:

1st: Internal Review

2nd: Internal Review*

3rd: External Review

4th: Regulator Complaint

Anytime: Legal Action

Relevant regulator:

State Insurance Commissioner (NAIC)

Federal Employee Health Benefits

Appeal options:

1st: Internal Review

2nd: OPM Review

4th: MSPB Review*

5th: EEOC or OSC Complaint

Relevant regulator:

Office of Personnel Management (OPM)

Medicare & Medicare Advantage

Appeal options:

1st: Internal Review

2nd: External Review

3rd: OMHA/ALJ Hearing

4th: Appeal Council Review

5th: Judicial Review

Relevant regulator

Centers for Medicare & Medicaid Services (CMS)

Medicaid

Appeal options:

1st: Internal Review

2nd: Local Hearing*

3rd: State Hearing

4th: Office of Appeals*

5th: Legal Action

Relevant regulator:

State Medicaid Agency

* Optional or not always part of the process.

** See TRICARE and the Veterans Affairs for military or veteran related appeals.

Can Government Agencies Help?

Yes! Insurance plans are regulated by federal or state agencies that handle complaints and make sure insurers follow the rules. Here are some key regulators to know:

- Department of Labor (EBSA / ERISA): For self-funded employer plans

- State Departments of Insurance: For fully-insured employer plans, state or local government employers, and individual or exchange-purchased plans

- Centers for Medicare and Medicaid Services: For Medicare and Medicare Advantage plans

- State Medicaid Agencies: For Medicaid plans

- Office of Personnel Management : For federal employer plans

Do I Need Legal Help?

Claimable doesn’t provide legal advice, but if you’ve exhausted your appeals or face an urgent issue, legal support might help. Look for attorneys who specialize in health insurance denials—especially in cases involving bad faith or breach of contract.

Resources For Financial Help

If the costs are piling up, consider these resources:

- Patient Assistance Programs: Offered by pharmaceutical companies to provide free or discounted medications.

- Non-Profit Organizations: Groups like HealthWell Foundation, PAN Foundation or Good Days help cover treatment costs.

- Discounts, Coupons or Copay Cards: Pharmaceutical companies or third parties like GoodRx offer coupons, rebates, savings cards, free trial cards or free samples.

- Government Programs: Medicare Part D Extra Help or Medicaid offer financial aid.

- Debt Forgiveness: Programs like Undue Medical Debt or Dollar For help with medical debt relief.

Want to Learn More?

We highly recommend Marshall Allen’s book, Never Pay the First Bill: And Other Ways to Fight the Health Care System and Win, for more tips on navigating the healthcare system.

A behind the scenes look at how Claimable’s AI works to help patients level the playing field and reclaim control of their care and coverage.

What's behind our platform? Artificial intelligence is our superpower.

AI and automation have, for better or worse, become a common part of the health insurance industry. These technologies are used daily by insurers to review claims and, often unjustly, deny them.

At Claimable, we’re building AI tools that empower you - the patient. We’re leveling the playing field, leveraging technology to help you reclaim control and get the care you’re owed.

But what does that mean exactly? Let’s dive in and explore how our AI technology works, and why it gives you an appeals advantage unlike anything else.

Who are the real-life people behind your AI?

First, let me introduce myself. I’m Zach, Chief AI Officer. Before co-founding Claimable I spent nearly 15 years at the US Department of Veteran Affairs, serving most recently as Chief Data Scientist. I’m also a lecturer at the University of Iowa Tippie College of Business. All that to say, I’ve devoted my career to building innovative technologies that improve patient’s access to care.

At Claimable, my team of engineers worked hand in hand with accredited doctors and insurance insiders, spending months researching, developing, and fine-tuning our AI-powered appeals platform. And our work is never done.

As an NVIDIA Inception Program member, we continue to push the boundaries of AI innovation in healthcare. AI is evolving rapidly, as are insurance policies and regulations, and we’re constantly enhancing the experience so that you have access to the latest and greatest AI has to offer.

How is AI Being Used to Generate My Appeal?

To start, we gather the details of your case. Don’t worry, it’s easy. We’ll ask you a few questions and have you upload relevant paperwork. From there, AI takes care of the rest. Our custom-built technology takes your specific case details and cross-references them against a huge database of published medical evidence, applicable laws, and other relevant sources. Using large language models and machine learning algorithms, we synthesize large amounts of data into a clear, legally sound argument advocating for your right to receive care.

In addition to gathering relevant information, our AI is trained to recognize patterns in successful appeals and apply these insights to new cases, continually improving over time and allowing you to leverage the success of previous appeals in your own.

This is the incredible power of AI and how it gives you superhuman appeals powers, with just the click of a button.

Will It Be Personalized to My Situation, or a Form Letter?

Every appeal generated by Claimable is highly personalized. It assesses each case on its merits, considering individual patient details, medical history, and relevant precedents. Unlike generic form letters, each appeal is uniquely tailored to address the specific points of your denial, significantly improving the likelihood of a successful outcome.

Are Any Humans Involved In The Process, Or Is It 100% AI-generated?

The process of creating your appeal is done exclusively by AI. Think of it like having your very own team of AI-powered researchers, writers, and editors. The researcher and wordsmith AI draft your appeal, and the editor AI makes sure everything is correct and trustworthy. This two-step process ensures that your appeal is both correct and compelling. If there are issues with an appeal, our review team can work to resolve them.

Will It Sound Like A Robot Wrote It?

Our AI is programmed with advanced language models that produce text indistinguishable from a human professional. In other words, no robot voice here. We understand the importance of tone and language in appeals, and our AI captures them expertly. This ensures your appeal document is not only effective but also empathetic and articulate.

Will I Need to Know How to Word a Prompt?

No, you do not need to know how to word a prompt for our AI. The system is designed to be user-friendly; you simply share the necessary details of your denial, and the AI handles the rest. The Claimable experience guides you through every step of the way, no technical experience required.

I’m Not An Appeals Expert, Am I Expected To Catch Mistakes?

We don’t expect you to be an expert. Few people, including most doctors, are! That is why Claimable includes multiple layers of checks. After the initial draft is created, other AI models, trained as reviewers, analyze the content for errors or misrepresentations, correcting them before the appeal is finalized. Learn how to review an appeal here.

How Do You Prevent Hallucinations?

A hallucination is a response generated by AI that contains false or misleading information presented as fact.

To prevent hallucinations, Claimable uses only verified data sources and cross-references information across multiple databases.

If an inconsistency is detected, the system automatically flags and revises the questionable content, ensuring reliability and accuracy.

What If I Need To Reach An Actual Human For Help?

Once your appeal is ready, you'll have the opportunity to review it. If you spot anything that doesn’t look right, you can mark it for further examination. Our system is designed to catch and correct most issues automatically. However, if there’s a need for additional oversight, our team is prepared to step in and ensure everything is handled correctly, providing support when necessary.

Wouldn’t It Be Better If My Doctor Did This vs AI?

While doctors are experts in medicine, they are not trained in insurance appeals. Claimable specializes in legal argumentation and persuasive writing, often outperforming standard doctor-written appeals in terms of depth, thoroughness, and compliance with legal standards.

That said, your doctor can still support your appeal process. Learn more about how best to work with your doctor here.

How Is This Different From ChatGPT and Similar Platforms?

Unlike general-purpose AI models like ChatGPT, Claimable is specifically designed for medical legal appeals, making it far more effective and precise for your specific needs.

It not only stays updated with the latest medical evidence, legal changes and recent case developments but is also built to comply strictly with HIPAA regulations. This ensures that all your personal and medical information is handled with the utmost security and confidentiality, safeguarding your privacy throughout the process. This tailored focus and commitment to compliance make Claimable uniquely reliable and secure for handling sensitive medical appeals.

Is My Health Information Safe?

All of your data is handled with strict adherence to HIPAA regulations, ensuring your personal information is protected with the highest standards of security and confidentiality. Claimable uses encrypted data storage and transmission protocols to safeguard your information from unauthorized access.

When it comes to insurance appeals, we believe everyone is entitled to fast, affordable, effective support.

Lawyers are expensive, and doing it yourself takes huge amounts of time and expertise that most of us just don’t have. By leveraging Claimable’s AI-powered platform, you have access to a powerful, efficient, cost-effective, and safe solution, right in the palm of your hand. Insurers are making technology work for them, it’s time you do too.

Featured stories

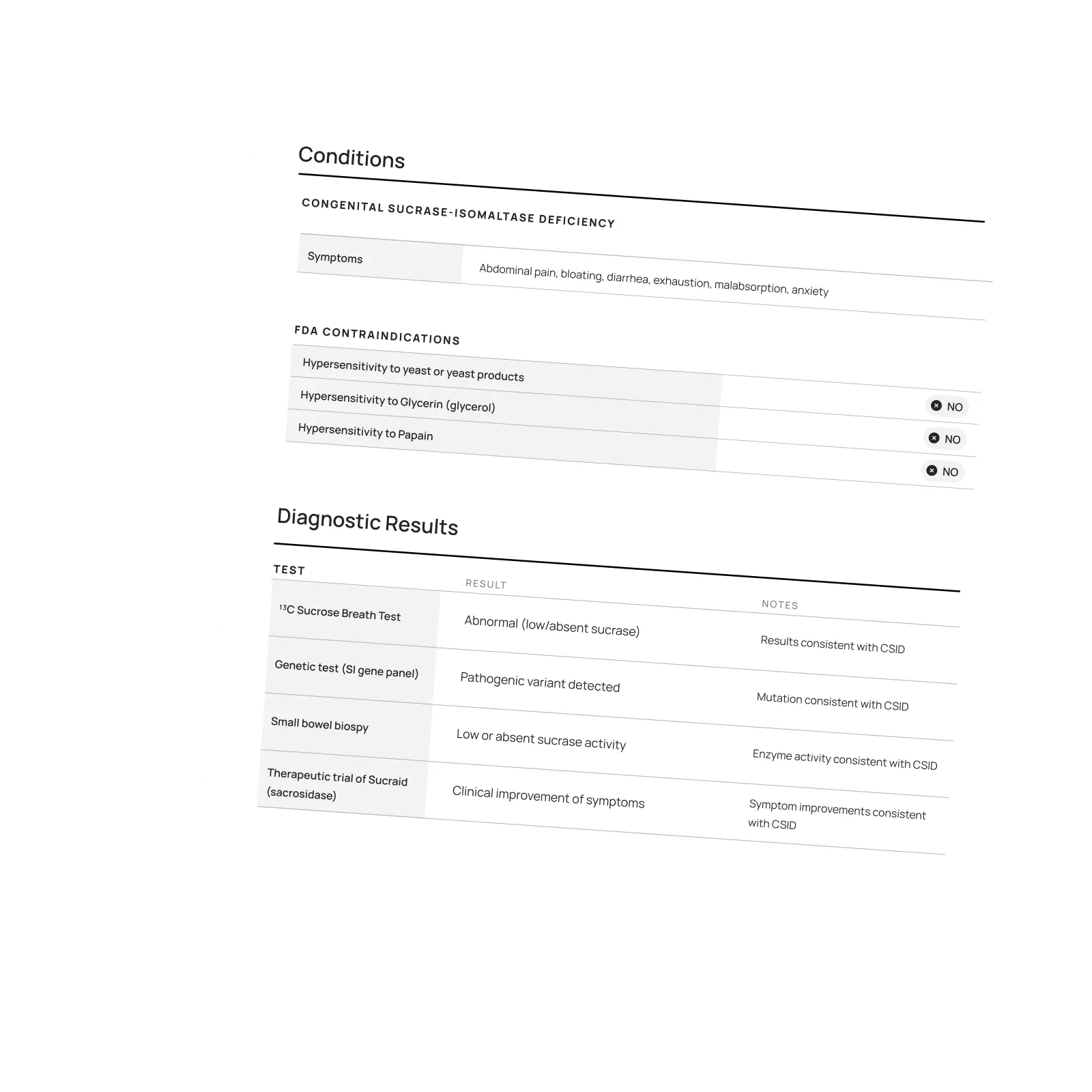

Download a winning sample appeal

Want to see what it takes to successfully overturn a health insurance denial? Download our sample appeal to learn how we build strong, evidence-based cases that get results.

///////////////////////////////////////////////////////////////////////

//////////////////////////////////////////////////////////////////////////

////////////////////////////////////////////////////////////////////

/////////////////////////////////////////////

Each month, I endure about eight major episodes, each one leaving me exhausted, unable to concentrate, and too unwell to take part in daily life.

The frequency and unpredictability of these symptoms have isolated me socially and limited my capacity to take part in activities most people take for granted.

///////////////////////////////////////////////////////////////////////

//////////////////////////////////////////////////////////////////////////

////////////////////////////////////////////////////////////////////

/////////////////////////////////////////////

Be the first to know

Get the latest updates on new tools, inspiring patient stories, expert appeal tips, and more—delivered to your inbox.

You're on the list!

One of our core principles is to help patients protect their rights and level the playing field with their insurance company. This includes rights to multiple appeals, fair reviews, decision rationale, exceptions when needed, and adequate network access, among others. For more, read our post on patients rights.

Claimable’s AI-powered platform analyzes millions of data points from clinical research, appeal precedents, policy details, and your personal medical story to generate a customized appeals in minutes. This personalized approach sets Claimable apart, combining proprietary and public data, advanced analysis and your unique circumstances to deliver fast, affordable, and successful results.

We currently support appeals for over 85 life-changing treatments. Denial reasons may vary from medical necessity to out of network, and we even cover special situation like appealing plans that won’t count your copay assistance towards your deductible (hint: those policies were banned at the federal level in 2023). That said, we are rapidly growing our list of supported conditions, treatments and reasons. You can quickly check eligibility and ask to be notified when your interest becomes available. It helps us know where to focus next 🙂

We think about appeal times in a few ways. First, many professional advocates and experienced patients spend 15, 30 or even 100 hours building an appeal–but with Claimable, this takes minutes. We automate the process of analyzing, researching, strategizing and wordsmithing appeals. Next, there is the process of figuring out where you will send it (hint: expand your reach beyond appeal departments), then printing, mailing and/or faxing your submission. We handle that, too. Finally, there is the time it takes to get a decision. We request urgent reviews when appropriate, and typically receive standard appeal decisions within a couple weeks.

Review periods are mandated by applicable laws, from 72 hours for urgent, 7 days for experimental, 30 days for upcoming and 60 days for received services. Our goal is to get a response as fast as possible, since most of our clients are experiencing long care delays or extreme pain and suffering.

Claims are denied for a variety of reasons, many of which blur definitions. We focus on helping people challenge denials by proving care is needed and meets clinical standards, in addition to addressing specific issues like experimental treatments, network adequacy, formulary or site of care preference exceptions. We don't support denials for administrative errors or missing information, as we think those are best handled by simply resubmitting the claim in partnership with your provider. That said, many of our most rewarding successes have been cases previously though 'unwinnable', with providers and patients who fought tirelessly for months without appropriate response or resolution.

A denial letter is a formal notice from your insurance company explaining why a claim was denied and how you can appeal the decision. Sometimes the notice is included within an Explanation of Benefits. It is a legal requirements; if you didn’t receive one, contact your insurance company.

A letter of medical necessity is a statement from your doctor justifying why a specific treatment is critical to your care and/or urgently needed. You can attach it to your patient appeal to strengthen your case, especially if you are requesting an urgent appeal or need to skip standard ‘step therapy’ requirements. That said, we don’t require them and are often successful without them.

A claim file contains all the documents and communications your health plan used to decide whether to approve or deny your claim. Most health plans are legally required to share this information upon request. According to a ProPublica investigation, reviewing your claim file can help expose mistakes or misconduct by your health plan, which can make your appeal stronger.

Your insurer is required by law to give you written information about how to appeal, including the name of the company that reviewed your claim and where to send your appeal. Your health insurer may work with other companies, such as Pharmacy Benefit Managers (PBMs), Third-Party Administrators (TPAs), or Specialty Pharmacies, to manage your claims. These companies might be responsible for denying your claim and handling the appeal process on behalf of your insurer.

If you don't win your first appeal– don't give up! Many people are successful on their 2nd, 3rd or even 4th try, and future appeals are reviewed by independent entities. That said, we wrote a whole guide to understanding your options, including escalating your appeal and seeking other assistance for covering costs, forgiving debt or even seeking legal or regulatory support.

While both denial rates and appeal success rates vary widely by the type of health plan, state, and insurance company, studies have shown more than 50% of people win their appeal–and we apply strategies to boost your chances of success. Claimable has an 80% appeal success rate. The biggest denial challenge is that most people never appeal–allowing unjust denials to control their healthcare options because they are unaware of their rights or lack the support needed to fight back. No one needs to fight alone–Claimable is here to help. We know first hand that many denials are based on errors, inconsistencies or auto-decisions, and have proven strategies for fighting back against this injustice.

Let’s get you covered.