Resources

Latest Posts

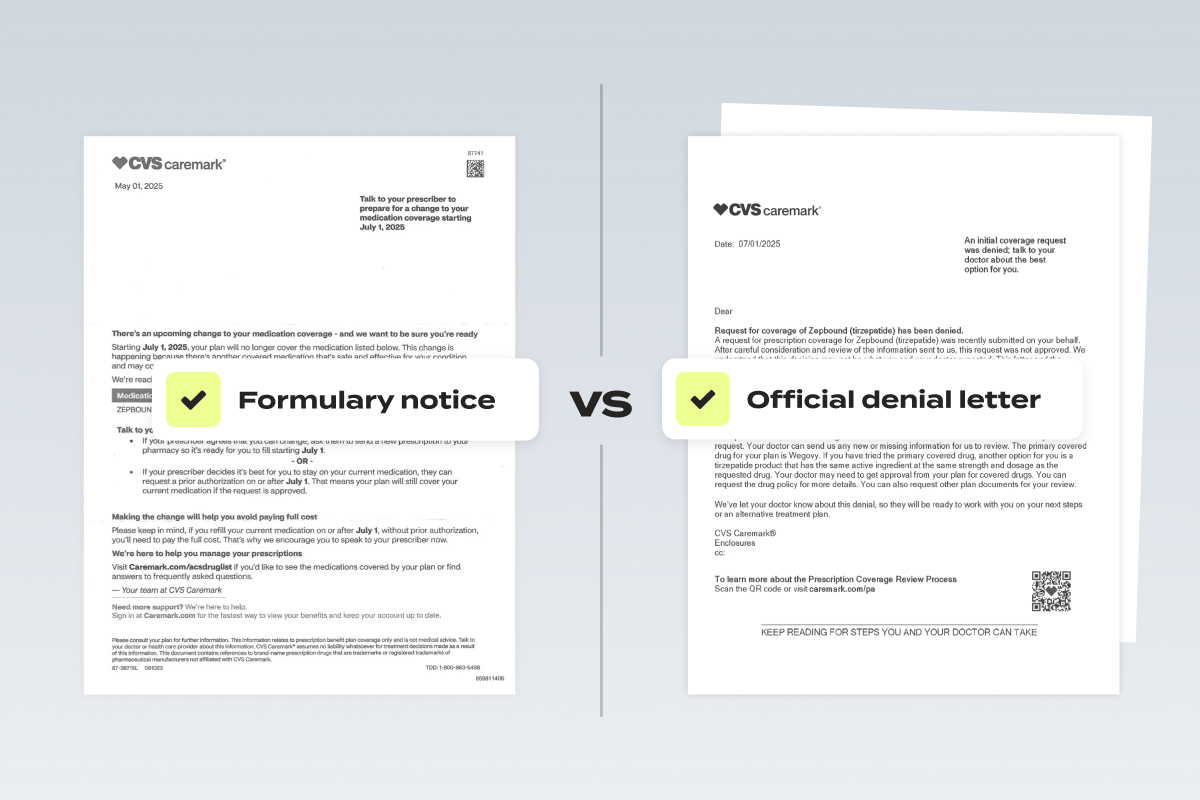

If you’re one of the many patients impacted by the forced switch from Zepbound to Wegovy, you’ve probably received a confusing series of letters and messages – some from CVS Caremark, some from your doctor, and maybe even some from your pharmacy. Understanding what each document means is key to getting back on the path to coverage.

This article breaks down the three critical documents you’ve likely received through the process. We’ll show you what they are, what they mean, and – most importantly – how to use them to get covered again.

👉 If you haven’t already, check out our full guide to fighting the Zepbound switch here.

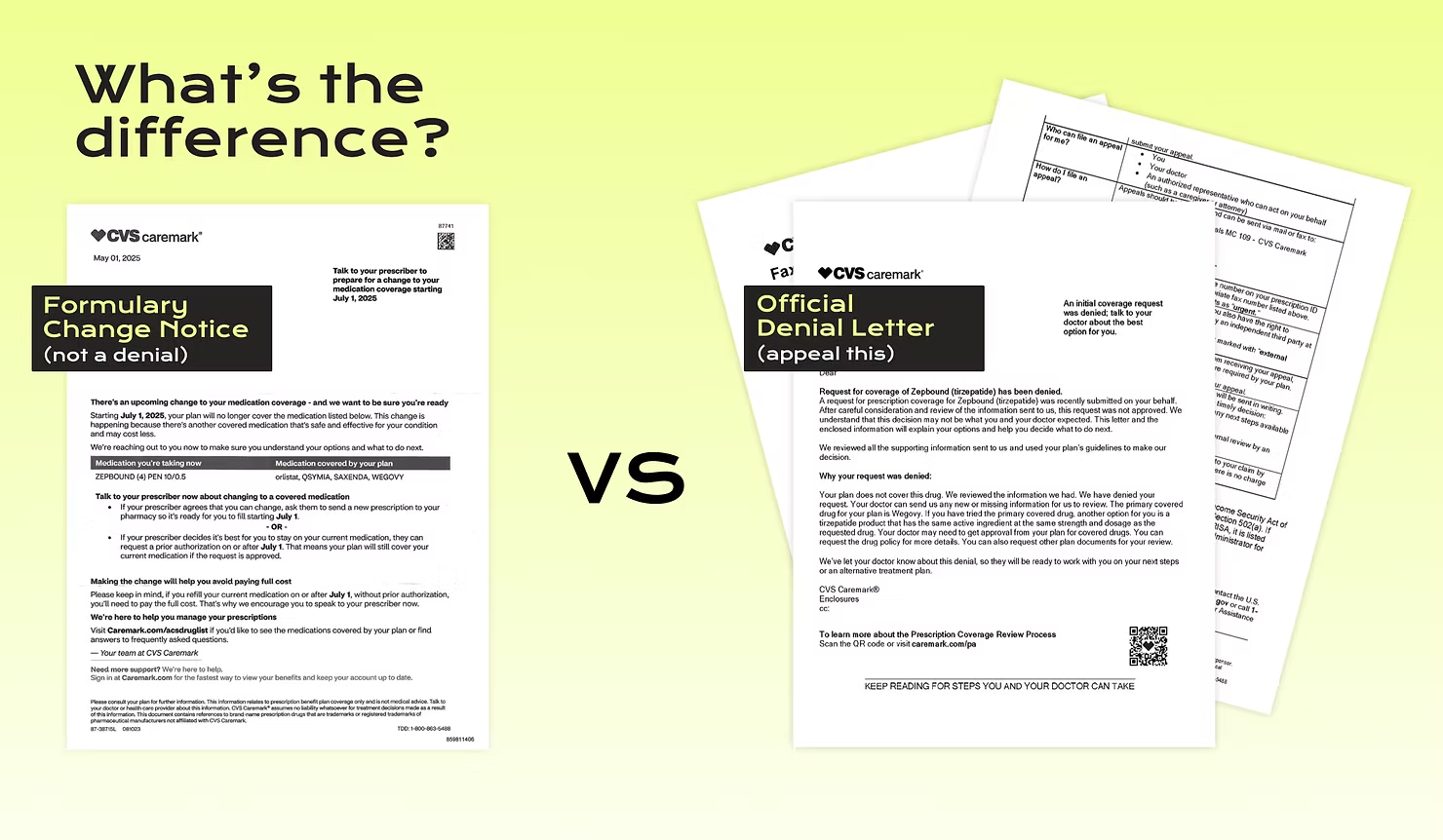

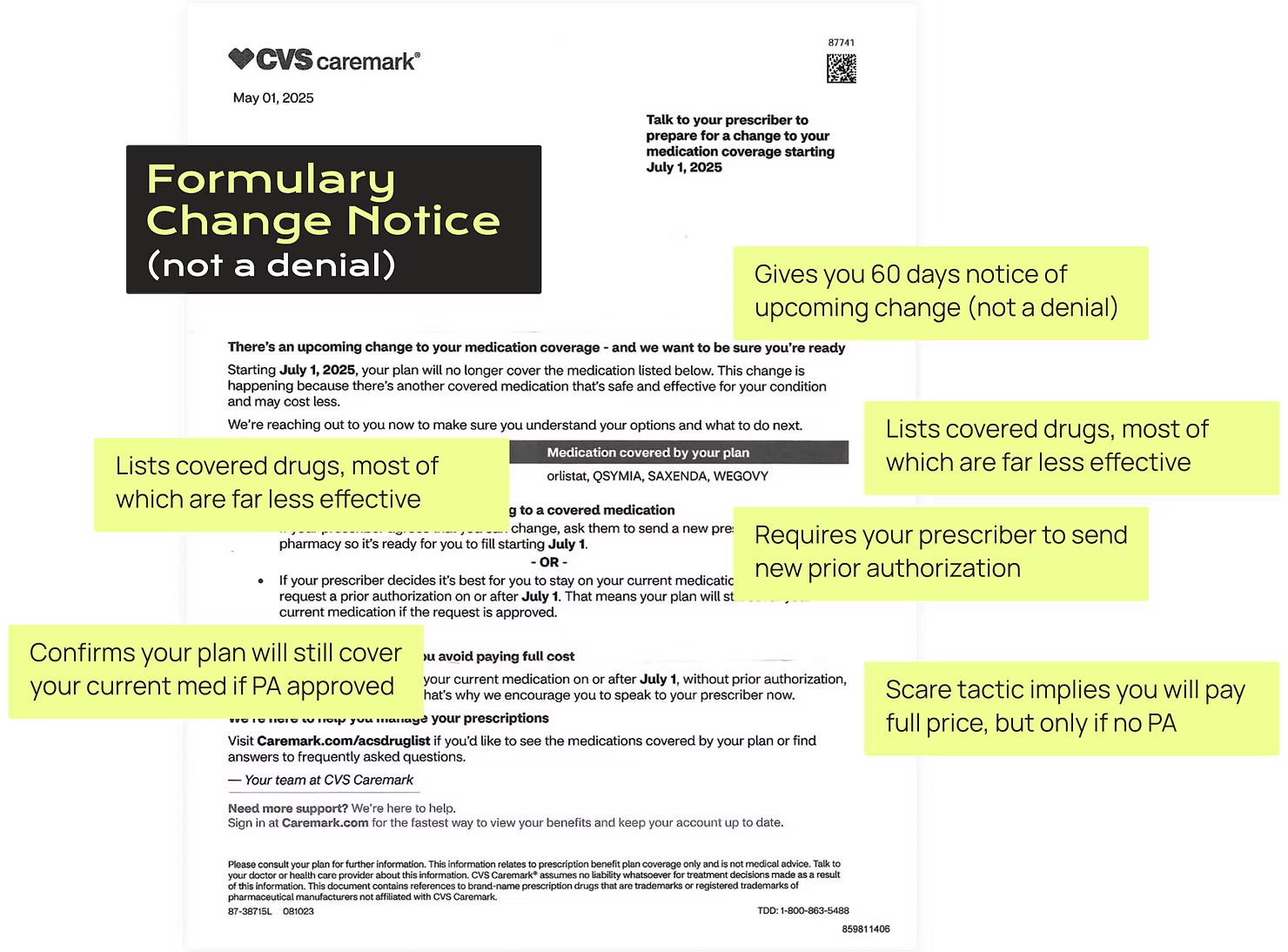

Document 1: The Formulary Change Notice Letter

What it is:

A notification of an upcoming change to your coverage. This letter tells you that soon, a change to formulary or drug policy will remove Zepbound and prefer Wegovy. It lays out steps to prepare, such as when to file a new prior authorization (for most people, after July 1st) and how to switch your prescription.

Why you get it:

Health insurers and pharmacy benefit managers, like CVS Caremark, must provide 60 days’ advance notice to plan participants before any mid-year formulary change that removes a drug from coverage or limits its availability (e.g. adds step therapy, prior authorization, or tiering).

How to read it:

The truth? There’s not a lot in here. These letters often use vague language like “no longer be covered” and “you’ll need to pay the full cost”, but don’t provide specifics. That’s because, importantly, this is not a denial, which is required to provide you much more detail.

Key takeaway:

This letter alone does not mean that your Zepbound prescription has been denied, or trigger your right to appeal. It’s a heads-up, not a final decision.

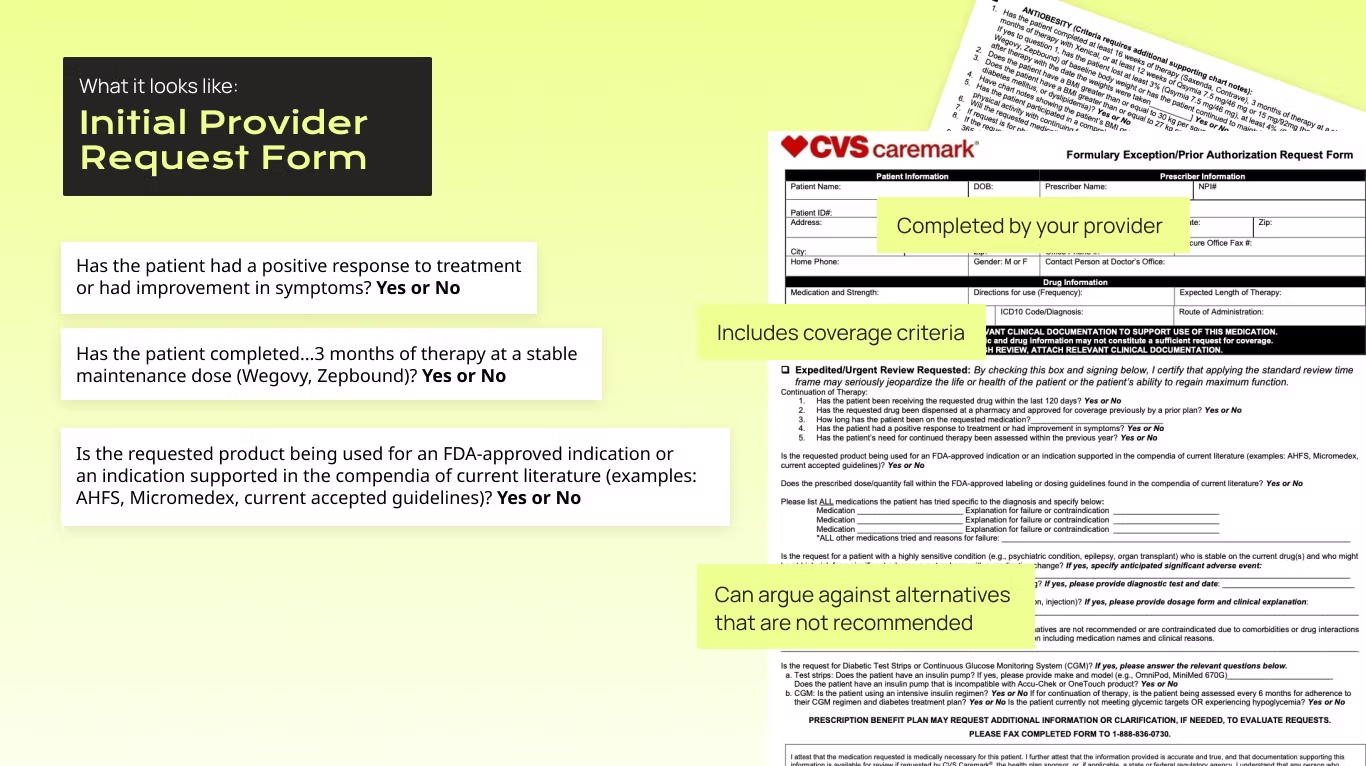

Document 2: Your Doctor’s New Prior Authorization Form

What it is:

A prior authorization is a form your doctor submits ahead of prescribing something, so the insurer can sign off on your treatment before it gets prescribed. With the Caremark switch, even if you had a prior authorization (PA) approved for Zepbound, your doctor must submit a new one after July 1. This is the PA form they must submit, and we also recommend they draft a letter of medical necessity.

Why it’s necessary:

Because Caremark’s formulary changed, all existing PA approvals under the old formulary are essentially wiped out. Your provider needs to justify, again, that the treatment is medically necessary and follows standard guidelines. If this feels like a huge waste of time, providers agree: PA has been proven to delay care and harm patients, and it’s costly for providers to complete.

How to use it:

Ask your doctor if a new PA has been submitted. This is your official request for your insurance to cover Zepbound, and it needs to be on record after July 1 for the appeals process to work. For best results, have them include a letter of medical necessity (you’ll also want this ready for your appeal). A little appreciation goes a long way.

Key takeaway:

An official denial won’t come until a new PA is submitted. This form restarts the process.

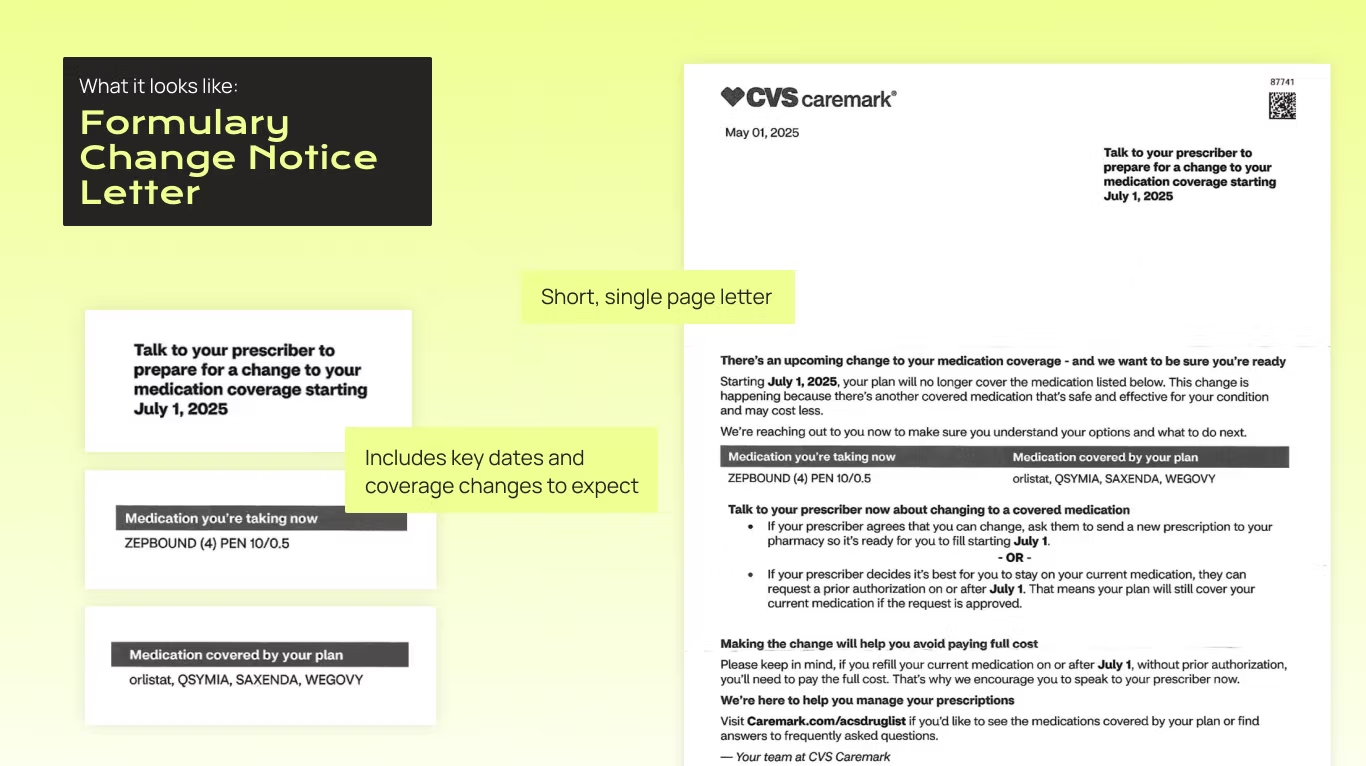

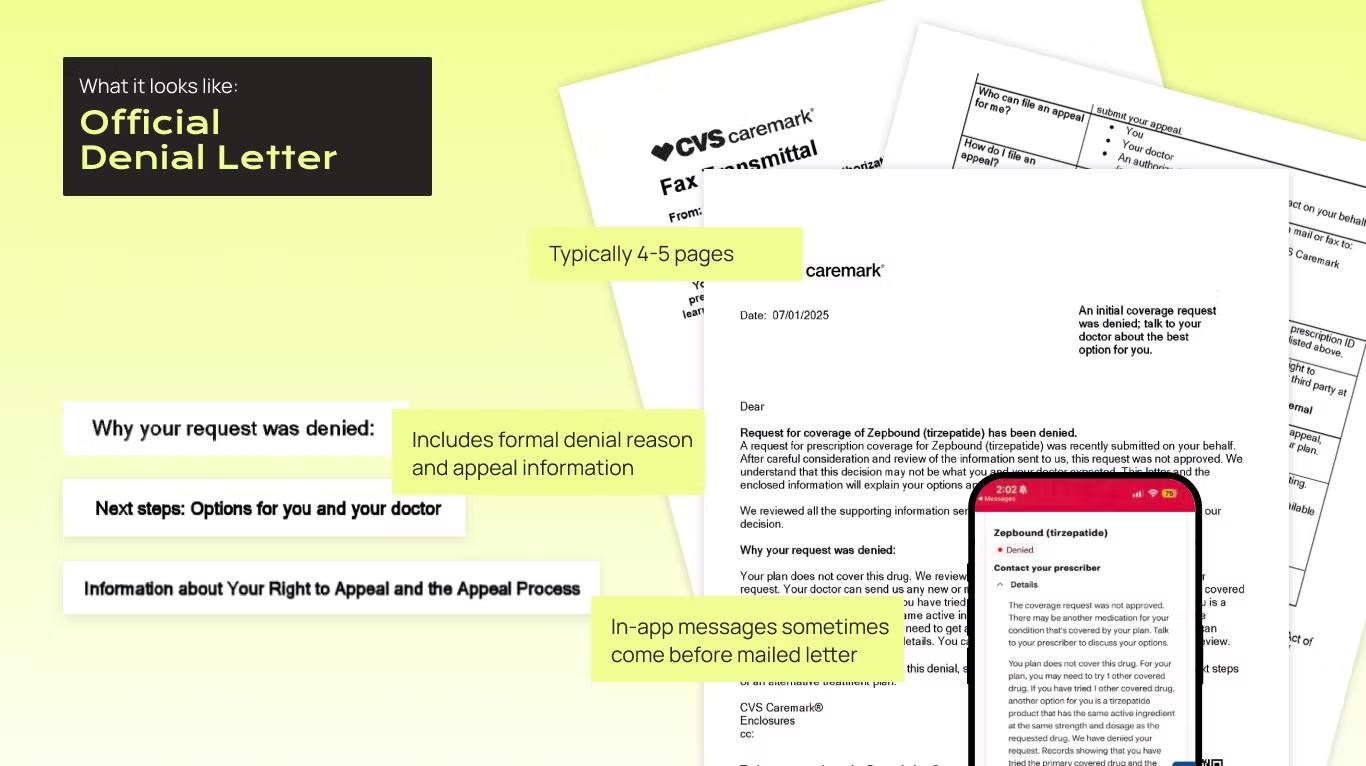

Document 3: The Denial Letter (Now You Can Appeal)

What it is:

This is the official decision from your insurer rejecting the PA request for Zepbound. It typically arrives by mail or through your health plan portal.

Why you get it:

Insurers and PBMs (like CVS Caremark) are legally required to ensure you understand the reason for a coverage denial and have a meaningful opportunity to appeal. When denial language is vague, incomplete, or misleading, it undermines this legal purpose and obstructs fair access to care – and if that happens, we can help you fight it.

How to read it:

Look for the specific denial rationale and appeal instructions. You might see language like “the primary covered drug for your plan is Wegovy” or “another option for you is a tirzepatide product.”

This language is misleading: You always have the right to request a formulary exception when no equivalent alternative exists. Zepbound is the only FDA-approved tirzepatide for obesity and sleep apnea, and has also been proven to be more effective, with fewer side effects, than Wegovy. Thus, it is the only tirzepatide product that should be covered by your plan.

What we think? This gives you a strong case to stay on Zepbound in your appeal.

Key takeaway:

This denial is what makes you eligible to file an appeal. If you haven’t gotten this yet, first make sure the PA has been submitted. If you appeal before you get this denial, it may be rejected or ignored – but don’t worry if this happens. You can resubmit.

Putting It All Together

A successful Zepbound appeal means getting the documents right:

1. The 60-day notice tells you this is coming, but isn’t a denial.

2. Your doctor’s new PA starts the process under the new rules.

3. Your denial letter gives you the right to appeal.

👉 If you’ve received your denial letter and are ready to appeal, Claimable can help you fight back in minutes. Get started today.

Need Help?

Still confused? You’re not alone. These documents weren’t designed for patients. That’s why Claimable exists – to help you translate legal jargon into action. Reach out at support@getclaimable.com.

When your insurance denies coverage for something your doctor says you need, it can feel like hitting a wall. The treatment is medically necessary. Your provider agrees. And somehow, your insurer still says “no.”

At that point, most people do the same thing: they call their doctor’s office and ask them to help. That makes sense – most patients haven’t had to appeal an insurance decision before, and assume that since the prescription came from their doctor, so should the appeal to cover it.

But here’s what most people don’t know: health insurance appeals aren’t just medical arguments. They’re regulatory, contractual, and strategic. They require paperwork, persistence, and the ability to challenge a policy – not just explain a diagnosis.

Saying the quiet part out loud: your doctor’s appeal isn’t always enough. Sometimes, it’s not even the best place to start. That’s why if you want the best shot at getting coverage approved, you should appeal it yourself.

What’s the difference between my appeal and one that comes from my doctor?

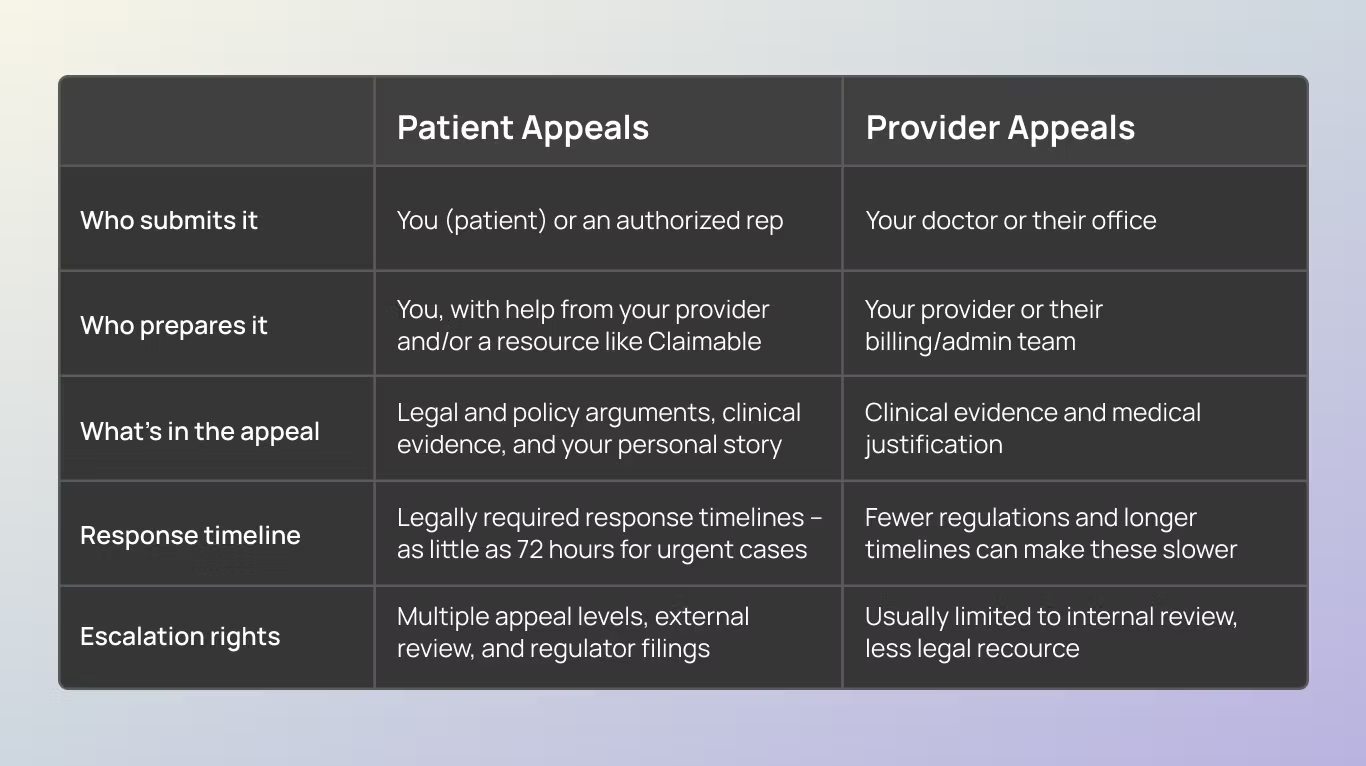

When your insurer denies a medication, treatment, or service, there are two types of appeals that can be submitted:

- A provider appeal is when your doctor or their billing team contacts your insurer to argue that the treatment is medically necessary. These usually happen through the insurer’s internal system and often involve submitting clinical documentation.

- A patient appeal is when you, the person covered by the plan, formally challenge the denial. This taps into patient and consumer protections, and gives you access to additional tools, like independent reviews and mandated timelines and processes.

They may sound similar, but they vary. How are these types of appeals different?

Now you can see some of the strengths that come from choosing to appeal yourself, as a patient – but it might still seem scary to take on. Apprehension about appeals isn’t an accident – insurers have spent years trying to make this seem hard, so people don’t do it.

Common misconceptions about insurance appeals – and what they get wrong.

If you’ve never appealed an insurance denial before, you’re not alone (and you’re not behind). Most people don’t learn how this works until they have to.

This is often made harder by the assumptions people make about appeals. Here’s three of the most common misconceptions—and the truth about what actually works when you’re fighting a denial.

Misconception #1: “My doctor will take care of it.”

We hear this all the time. You get denied, and your first call is to your doctor to ask what to do. After all, they prescribed the treatment – surely it’s up to them to explain why you need it covered, right?

Why this doesn’t work:

Your doctor can support an appeal, but they’re not insurance policy experts – and more importantly, they’re not the one whose plan is in question here. Their top priority is to care for their patients, and they have limited options and resources to address the rising denial volume.

The reality:

You, the patient, hold the contract. The job of an appeal is to prove a denied treatment or service was contractually obligated to be paid for. This is equal parts a patient and consumer protection issue.

Misconception #2: “I don’t know how to do this — I’ll mess it up.”

It makes sense to feel this way – the healthcare system is overwhelming, and insurance is confusing on purpose. They want you to give up. That means that if you’ve never appealed before, it can feel like you’re not qualified to try.

Why this doesn’t work:

Assuming you’re not capable leads to inaction while you search for someone else to do it. Lawyers are expensive and don’t take many cases. Doctors don’t have the time, resources or rights to escalate appeals. And every time an unjust denial goes unchallenged, insurers are emboldened to deny more medically necessary care.

The reality:

Not long ago, it felt impossible to make this case on your own. Not anymore. With tools like Claimable, all you have to do is share your story and answer a few easy, guided questions. Then, we’ll pull all of the right laws, policies, and studies to make you the strongest appeal.

Misconception #3: “Its pointless — If they denied me, it must not be covered.”

This is what insurance companies want you to believe. That a denial is final, that you’re out of options, and that fighting back is too complicated or hopeless to be worth it.

Why this doesn’t work:

It causes people to give up on treatment they need, or to pay out-of-pocket for something their insurance might have covered – if only they had pushed back.

The reality:

Insurance companies deny coverage in error all the time – either due to mistakes or misconduct. Appealing is a built-in protection from a broken system. In fact, more than half of denials are overturned on appeal – and you have the power to take them on.

Why you should lead your own appeal

The best person to advocate for your care is you. Here’s why:

You hold the contract (and the legal rights that go with it)

Your doctor is there to care for you — but you’re the one who has a legal agreement with your insurance company. That gives you rights your doctor doesn’t have on their own, including state and federal protections.

When you appeal directly, you can:

- Trigger faster, legally mandated response times (like 72 hours for urgent cases)

- Escalate to external reviewers or regulatory agencies – including the ability to file complaints with your state’s insurance board

- Demand a full, fair review based on your policy’s language

You can move faster

When providers appeal, the paperwork often gets routed through internal insurer systems that are slow, opaque, and hard to track. Appeals can get stuck in “processing” or lost altogether.

When you appeal yourself, you’re in control. You don’t have to wait for office staff to call the insurer back or follow up on a fax. You set the pace – and you can hold your insurer accountable for timely responses.

You can make a stronger, more complete case.

Provider appeals are almost always focused only on clinical information. But winning an appeal often requires:

- Legal or regulatory arguments

- Citing FDA standards or policy precedent

- Personal impact statements about how the denial is affecting your life

Your doctor isn’t trained in insurance law. And they shouldn’t have to be. By appealing yourself — especially with help from a tool like Claimable — you can bring all these elements together into a comprehensive case that’s much harder to ignore.

You care the most – and in your appeal, that shows

Your doctor has hundreds of patients, dozens of responsibilities, and limited time. Appeals are just one more administrative burden in a broken system.

But for you, this appeal matters. It’s your treatment, your time, your health. That motivation — paired with the right tools — is what makes you the most effective person to lead the charge.

Why doctors don’t always win appeals (and that’s ok)

When you bring a denial to your doctor, they do what they can. A good provider is invested in your care, and they want to help get you the treatment they’ve prescribed. But the truth is: most provider-led appeals are brief, clinical, and limited in how far they can go.

Why? Doctors have no power over the insurance company. They don’t hold an insurance contract (like you do). And the system is set up to make it all too easy for the insurer just to say no all over again.

Here’s how provider appeals typically go:

- First, they write a letter of medical necessity and send it over.

- Once insurance denies it again, your provider has a “peer-to-peer review” with a doctor who works for the insurance company. The reality? The job of the peer reviewer is to explain to your doctor why the insurer isn’t going to pay for it.

- And that might be it – they’ve reached the end of the road on this appeal.

That’s not their failure – it’s just a reflection of the system. Doctors aren’t trained or resourced to fight complex coverage decisions. That’s not what they went to med school for. They’re here to take care of you. The rest is up to you – and tools like Claimable.

How to work with your doctor – while staying in the drivers’ seat on your care

Appealing yourself doesn’t mean doing everything alone. Think of it like this: you’re the quarterback, and your provider is your key teammate.

When you get denied, here’s how to work with your doctor on your appeal.

- Loop them in: Let their office know that your medication or service was denied, and that you plan to submit your own appeal. Most will be supportive — and sometimes relieved — that you’re taking the lead. Try this:

- “I’m planning to appeal my denial directly, since I can escalate it beyond internal review. Would you be willing to support the appeal with a letter or documentation showing this treatment is medically necessary?”

- Ask for what they do best: Medical support. You don’t need them to write a legal brief – just a solid medical explanation. Request:

- A Letter of Medical Necessity (try our LOMN template to make it easy!)

- Diagnosis codes and chart notes\

- Any history of treatments that didn’t work

- Keep communication clear and focused. No need to forward your entire appeal draft. Instead:

- Summarize what you’re submitting

- Make 1–2 specific asks

- Respect their time — they’ll appreciate it

- Follow up and share your success: Let your provider know the outcome of the appeal. It helps close the loop and might even help future patients.

The easiest, most effective way to do your appeal

By now, we hope you see the value in taking charge of your appeal – and your care – directly. But researching all of the laws, policies, and . Luckily, you don’t need to be an insurance expert to write a winning appeal. That’s exactly what we built Claimable to do.

Here’s how it works:

- You answer a short set of questions about your medical and personal history

- You provide key documents, like your doctor’s letter of medical necessity

- We incorporate legal precedent, policy, and clinical standards

- We create a strong, customized appeal with the best arguments

- You approve – and we automatically sent it to your insurer and other key recipients

It’s that easy. In minutes – not days – you can build a case and fight back against your denial. And win.

The bottom line: You’re the best person to fight for your care

Your doctor is here to care for you. Your insurer is here to protect their business. And you? You’re the one who has the most to gain – or lose – from this decision.

Insurance companies count on confusion. On delays. On patients giving up. But you don’t have to play by those rules.

By appealing directly – and using every right the law gives you – you give yourself the best chance at getting the care you need. With your doctor on your side and Claimable in your corner, you’re not just filing an appeal. You’re creating a case that’s built to win.

You have the right. You have the tools. You’ve got this.

GLP-1 medications like Ozempic, Mounjaro, and Rybelsus have made incredible strides in how type 2 diabetes is managed. They’re more than just blood sugar meds – they help with weight loss, protect the heart, and improve long-term outcomes for millions of people living with chronic metabolic disease.

But even when you have a clear type 2 diabetes diagnosis, getting coverage for these medications isn’t always simple.

When it comes to GLP-1 prescriptions, patients are being denied. Not because they don’t qualify, but because insurers are putting up administrative roadblocks. Step therapy. A1C thresholds. “Missing” paperwork. Mandated programs. Short approval windows.

If this has happened to you, you’re not alone. And you’re not out of options. At Claimable, we’ve reviewed hundreds of real-world denials, dug deep into policy language, and built a fast, effective way to appeal – now available specifically for GLP-1 denials for type 2 diabetes.

Let’s dig into the denials. Here’s how insurance companies are making access harder—and how you can fight back.

You have a diagnosis. So why did they say no?

Diabetes is a lifelong disease, and treating it isn’t optional. So you’d think that having a type 2 diagnosis would be enough to get your GLP-1 covered – especially for drugs like Mounjaro and Ozempic that are FDA-approved to treat it. But often, it’s not.

Here’s what’s really happening: Insurers are moving the goalposts.

Even with broad coverage in commercial insurance plans (97% for Ozempic and 99% for Mounjaro, per GoodRX), insurers still deny access for reasons like:

- Step therapy requirements: Forcing you to “fail” on older, less effective meds like metformin, sulfonylureas, or insulin before approving a GLP-1 – even when those options don’t align with current ADA or FDA guidance.

- Arbitrary A1C thresholds: Denying you if your A1C is “too low” (even if you’ve been actively managing your diabetes), and keeping it out of reach with extreme A1C requirements not backed by evidence. We’ve seen A1C requirements as high as 8 or 9%, when the standard threshold is ≥6.5%.

- Documentation traps: Denials for “missing labs” even when they were submitted. Or for using initial criteria rules at renewal, which penalizes patients for improving.

- Mandatory diabetes programs: Insisting you enroll in programs like Teladoc or Omada before they’ll approve coverage – despite no ADA or FDA requirement to do so.

- Short-term approvals: Limiting authorizations to 1-3 months, even when your policy says 8-12 – forcing patients to constantly repeat paperwork and risk lapse if something goes wrong with an approval.

These aren’t medical decisions. They’re red tape designed to slow things down—or wear you out.

What happens next? You appeal the denial. And you can win.

Appeals work. Especially for diabetes. But the key is making your case the right way – backed by documentation, personalized to your health story, and targeted to your plan’s specific rules.

The strongest cases blend clinical studies, medical history, and the most up to date.

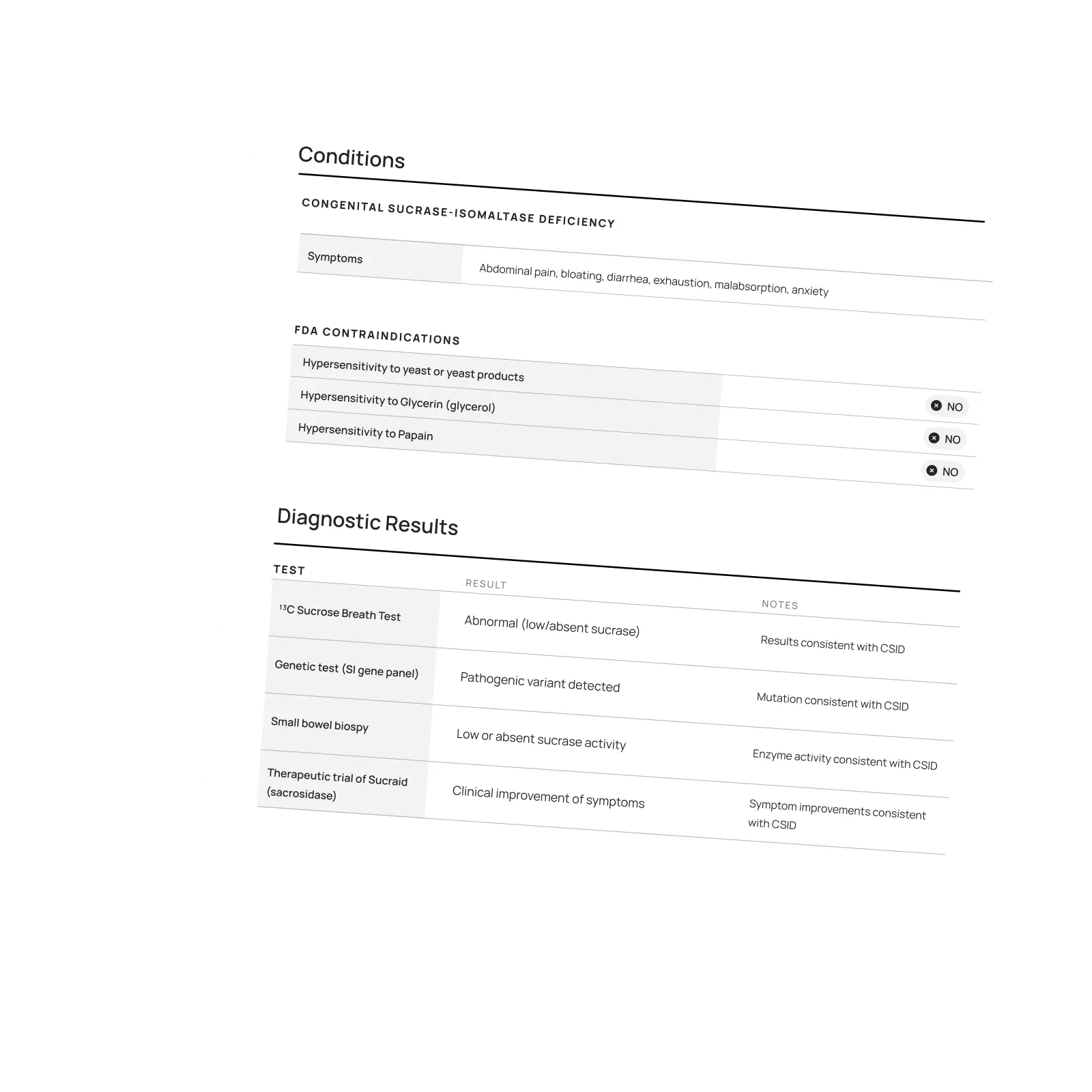

Here’s what we include in strong appeals to support GLP-1 coverage for type 2 diabetes:

- That you meet the criteria. Your diagnosis, your lab results (A1C ≥ 6.5%, fasting glucose ≥ 126 mg/dL, 2-hour glucose ≥ 200 mg/dL, or others), and your treatment history make a clear case for approval.

- Why step therapy doesn’t apply. We cite current clinical guidelines that support GLP-1s as a treatment for people with T2D, especially when weight, heart, or kidney concerns are present.

- Why rigid rules don’t reflect real care. Forcing you into a diabetes management program or denying based on an improving A1C ignores how chronic disease is actually managed.

- How your plan contract and relevant laws support coverage. Laws like ERISA, Section 1557 of the ACA, and state regulations protect your right to coverage. Plus, we review your plan in depth to make sure the insurer is in compliance with the policy they sold you (because denials often aren’t).

- What’s at stake. Your appeal can highlight risks of delaying care—like worsening blood sugar, increased cardiovascular risk, or medication lapses that undo your progress.

You don’t have to figure this out on your own. Claimable builds your appeal in minutes—so it’s easy to take action before the denial stalls your treatment.

Success isn't the end – it's just the start.

Even after you win an appeal, insurers may try to reimpose restrictions every few months. That’s why Claimable makes it easy to appeal, and re-appeal.

Our simple platform allows you to create an appeal in minutes, not days, anytime you need one. And for renewals, we make sure to highlight your progress in your appeal – arguing that improvements like a lower blood sugar, blood pressure, or cholesterol, are strong reasons to continue coverage for your GLP-1.

We’re here to help you stay on the treatment that’s working—not restart the fight every time your insurer changes the rules.

The bottom line: Denied doesn't mean defeated.

You have a diagnosis. You have a prescription. You’ve done everything right. A denial doesn’t mean you don’t qualify—it means the insurer is hoping you’ll give up.

At Claimable, we’re here to make sure you don’t.

Whether it’s Ozempic, Mounjaro, or Rybelsus, we’ll help you build a clear, effective appeal – personalized to your diagnosis, your plan, and your rights. No paperwork. No hold music. Just a smarter, faster way to fight back.

Because your diabetes care shouldn’t hinge on red tape.

Because chronic disease deserves continuous support – not constant obstruction.

Because one denial shouldn’t be the end of your story. Let’s get you covered.

Featured stories

Download a winning sample appeal

Want to see what it takes to successfully overturn a health insurance denial? Download our sample appeal to learn how we build strong, evidence-based cases that get results.

///////////////////////////////////////////////////////////////////////

//////////////////////////////////////////////////////////////////////////

////////////////////////////////////////////////////////////////////

/////////////////////////////////////////////

Each month, I endure about eight major episodes, each one leaving me exhausted, unable to concentrate, and too unwell to take part in daily life.

The frequency and unpredictability of these symptoms have isolated me socially and limited my capacity to take part in activities most people take for granted.

///////////////////////////////////////////////////////////////////////

//////////////////////////////////////////////////////////////////////////

////////////////////////////////////////////////////////////////////

/////////////////////////////////////////////

Be the first to know

Get the latest updates on new tools, inspiring patient stories, expert appeal tips, and more—delivered to your inbox.

You're on the list!

One of our core principles is to help patients protect their rights and level the playing field with their insurance company. This includes rights to multiple appeals, fair reviews, decision rationale, exceptions when needed, and adequate network access, among others. For more, read our post on patients rights.

Claimable’s AI-powered platform analyzes millions of data points from clinical research, appeal precedents, policy details, and your personal medical story to generate a customized appeals in minutes. This personalized approach sets Claimable apart, combining proprietary and public data, advanced analysis and your unique circumstances to deliver fast, affordable, and successful results.

We currently support appeals for over 85 life-changing treatments. Denial reasons may vary from medical necessity to out of network, and we even cover special situation like appealing plans that won’t count your copay assistance towards your deductible (hint: those policies were banned at the federal level in 2023). That said, we are rapidly growing our list of supported conditions, treatments and reasons. You can quickly check eligibility and ask to be notified when your interest becomes available. It helps us know where to focus next 🙂

We think about appeal times in a few ways. First, many professional advocates and experienced patients spend 15, 30 or even 100 hours building an appeal–but with Claimable, this takes minutes. We automate the process of analyzing, researching, strategizing and wordsmithing appeals. Next, there is the process of figuring out where you will send it (hint: expand your reach beyond appeal departments), then printing, mailing and/or faxing your submission. We handle that, too. Finally, there is the time it takes to get a decision. We request urgent reviews when appropriate, and typically receive standard appeal decisions within a couple weeks.

Review periods are mandated by applicable laws, from 72 hours for urgent, 7 days for experimental, 30 days for upcoming and 60 days for received services. Our goal is to get a response as fast as possible, since most of our clients are experiencing long care delays or extreme pain and suffering.

Claims are denied for a variety of reasons, many of which blur definitions. We focus on helping people challenge denials by proving care is needed and meets clinical standards, in addition to addressing specific issues like experimental treatments, network adequacy, formulary or site of care preference exceptions. We don't support denials for administrative errors or missing information, as we think those are best handled by simply resubmitting the claim in partnership with your provider. That said, many of our most rewarding successes have been cases previously though 'unwinnable', with providers and patients who fought tirelessly for months without appropriate response or resolution.

A denial letter is a formal notice from your insurance company explaining why a claim was denied and how you can appeal the decision. Sometimes the notice is included within an Explanation of Benefits. It is a legal requirements; if you didn’t receive one, contact your insurance company.

A letter of medical necessity is a statement from your doctor justifying why a specific treatment is critical to your care and/or urgently needed. You can attach it to your patient appeal to strengthen your case, especially if you are requesting an urgent appeal or need to skip standard ‘step therapy’ requirements. That said, we don’t require them and are often successful without them.

A claim file contains all the documents and communications your health plan used to decide whether to approve or deny your claim. Most health plans are legally required to share this information upon request. According to a ProPublica investigation, reviewing your claim file can help expose mistakes or misconduct by your health plan, which can make your appeal stronger.

Your insurer is required by law to give you written information about how to appeal, including the name of the company that reviewed your claim and where to send your appeal. Your health insurer may work with other companies, such as Pharmacy Benefit Managers (PBMs), Third-Party Administrators (TPAs), or Specialty Pharmacies, to manage your claims. These companies might be responsible for denying your claim and handling the appeal process on behalf of your insurer.

If you don't win your first appeal– don't give up! Many people are successful on their 2nd, 3rd or even 4th try, and future appeals are reviewed by independent entities. That said, we wrote a whole guide to understanding your options, including escalating your appeal and seeking other assistance for covering costs, forgiving debt or even seeking legal or regulatory support.

While both denial rates and appeal success rates vary widely by the type of health plan, state, and insurance company, studies have shown more than 50% of people win their appeal–and we apply strategies to boost your chances of success. Claimable has an 80% appeal success rate. The biggest denial challenge is that most people never appeal–allowing unjust denials to control their healthcare options because they are unaware of their rights or lack the support needed to fight back. No one needs to fight alone–Claimable is here to help. We know first hand that many denials are based on errors, inconsistencies or auto-decisions, and have proven strategies for fighting back against this injustice.

Let’s get you covered.